Flood Zone Definitions

Definitions

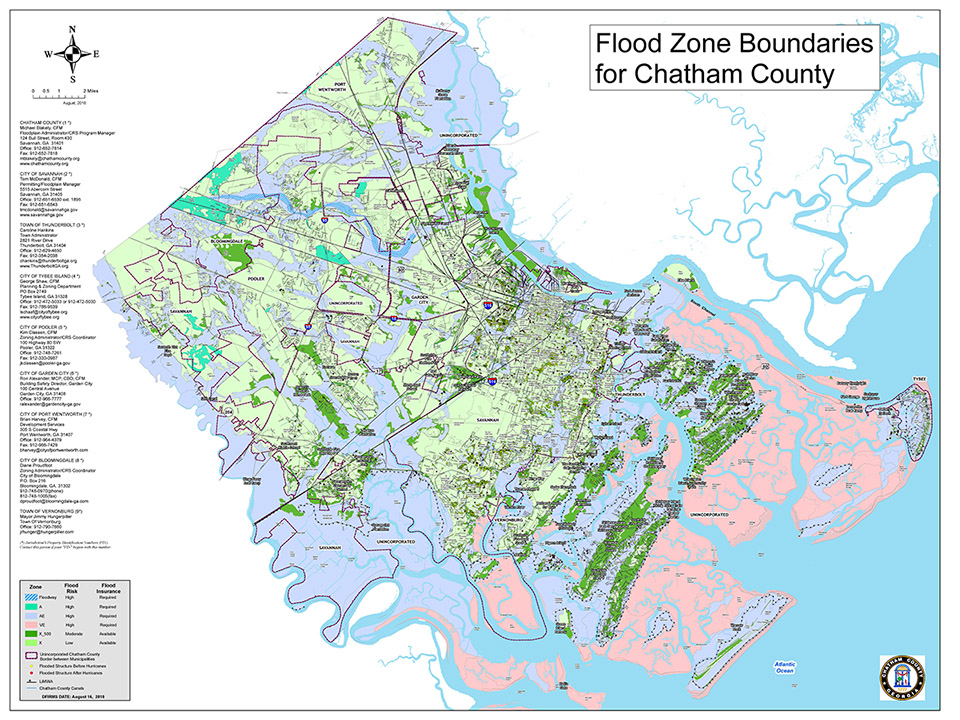

Flood maps, known officially as Flood Insurance Rate Maps (FIRMs), show areas of high- and moderate- to low-flood

risk. Flood maps have many uses. Chatham County Engineering uses the maps to set minimum building requirements for

coastal areas and floodplains; lenders use the maps to determine flood insurance requirements. Additionally, FEMA

uses FIRMs to help determine flood insurance rates.

FIRMs are available to the public free of charge through the FEMA Flood Map Service

Center at https://msc.fema.gov/portal

FIRMs depict flood areas in a series of zones. Zones that are considered “high risk” for flooding are known as Special Flood Hazard Areas (SFHAs). In the SFHA, properties have at least a 1 in 4 chance of flooding during a 30-year mortgage in high-risk areas.

Special Flood Hazard Areas (SFHA) are shown on the flood maps as zones beginning with the letters 'A' or 'V'.

Important to note: All home and business owners in high-risk areas with mortgages from federally regulated or insured

lenders are required to buy flood insurance.

Non-Special Flood Hazard Areas (Non SFHA) are moderate-to-low risk areas. So, the risk of flooding is reduced, but not completely removed. These moderate- to low-risk areas are shown on flood maps as zones beginning with the letters 'B', 'C' or 'X' (or a shaded X).

Flood insurance is not federally required in moderate- to- low-risk areas, but it is recommended for all property owners and renters as more than 20 percent of National Flood Insurance Program claims occur in the moderate- to low- risk areas which receive one-third of federal disaster assistance for flooding.

Reference: https://www.fema.gov/

Part of ChathamCountyGA.gov

Part of ChathamCountyGA.gov